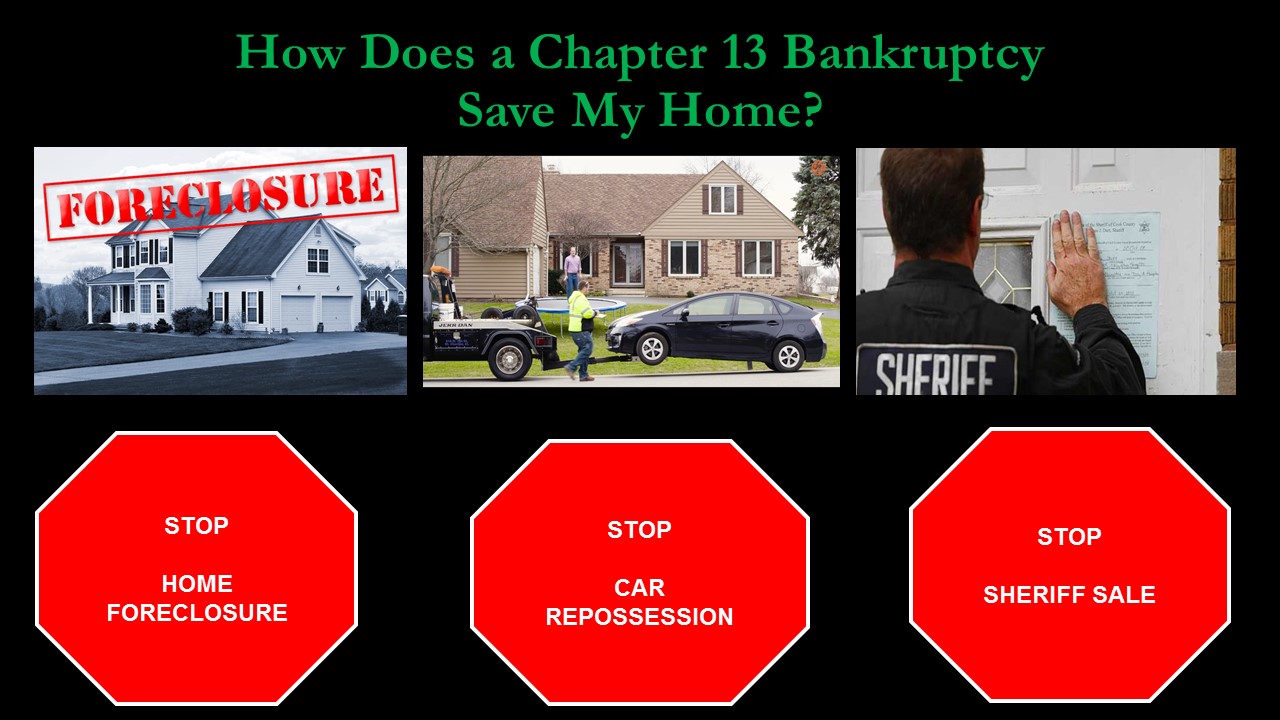

How Does a Chapter 13 Bankruptcy Save My Home?

When faced with unmanageable debt or the loss of property such as a home or car, filing bankruptcy may be an option for relief. If considering bankruptcy, you can file a Chapter 7 or Chapter 13 Bankruptcy. The answer to what is the difference between the two is found in this article: Chapter 7 vs. Chapter 13. If faced with the loss of your home to foreclosure or car to repossession, and you wish to keep the property, your only option is a Chapter 13 Bankruptcy. This article addresses: How Does a Chapter 13 Bankruptcy Save My Home?

Home Foreclosure and Car Repossession

Chapter 13 Bankruptcies primarily stop a home foreclosure, sheriff sale, or car repossession. These actions are faced by individuals when they fall behind in payments to their mortgage company or car loan company, known as being in default on the mortgage or loan. Once entering default on either type of loan, if attempting to become current, the lender demands the full balance of payments, fees, interests, and costs get paid in full; this amount required is the arrears.

In many instances, it is not feasible to pay the full amount of arrears, even if one’s financial situation has changed and payments can resume, the lump sum payment required is too much. This situation is where a Chapter 13 Bankruptcy comes in to save the property.

The Chapter 13 Bankruptcy filing stops the home foreclosure or car repossession or cancels the sheriff’s sale or car auction. Once under the bankruptcy protection referred to as the automatic stay, the debtor through his/her attorney attempts to restructure the debt and create a payment arrangement through a Chapter 13 Bankruptcy Plan.

What is the Chapter 13 Bankruptcy Plan?

Upon filing a Chapter 13 Bankruptcy, the debtor must also submit a proposed Chapter 13 Plan. The Chapter 13 Plan allows the debtor to propose a 60 month (5 year) payment plan for the mortgage or car loan arrears. Hence, avoiding the requirement to pay the full balance of arrears at once. If the Chapter 13 Plan is approved and all 60 payments made, the mortgage or car loan transfers to good standing, and the debtor successfully exits the Chapter 13 Bankruptcy.

The Chapter 13 Plan does include payments in addition to any arrears. The debtor must pay a percentage of the total Chapter 13 Plan balance to the trustee administering the case; in Pennsylvania, it is 10%. If the debtor is unable to pay his/her attorney fees at the time of filing, the attorney fees can get included in the Chapter 13 Plan. The Chapter 13 Plan may require addressing taxes owed or can consist of both mortgage and car loan arrearages.

How are Chapter 13 Plan Payments Made?

Upon filing the Chapter 13 Bankruptcy, the debtor must begin making Chapter 13 Plan payments 30 days after the bankruptcy filing. Additionally, the debtor must resume making the regular monthly payments to the mortgage company or car loan company within 30 days of filing. Therefore, the Chapter 13 Plan payment does not replace the mortgage or car loan payments but is in addition to them to cure the arrears.

The regular mortgage or car loan payments get paid directly to the lender. However, the Chapter 13 Plan payments get paid to the Chapter 13 Trustee via online payment, by mail in the form of a money order, or as a deduction from one’s paycheck.

Chapter 13 Plan Payment Example

Steve and Sarah have fallen behind in both their car and mortgage payments due to Steve losing his job. Steve obtains new employment, and the couple can resume making the regular mortgage and car payments but are unable to pay the arrears for both loans in a lump sum. The mortgage company files a foreclosure action, and the car loan company schedules a repossession of their car. Steven and Sarah meet with a bankruptcy attorney to file a Chapter 13 Bankruptcy.

The mortgage arrears total $22,000.00, and the monthly mortgage payment is $2,500.00. The car loan arrears are $8,500.00, and the monthly payment is $365.00. The attorney fee is $3,500.00 and filing fee $315.00; the couple only has $1,315.00 to give to the attorney. A balance of $2,500.00 remains owed to the attorney.

The balance of the arrears is $30,500.00 + attorney fee balance of $2,500.00, bringing the total Chapter 13 Plan balance to $33,000.00. The Chapter 13 Trustee fee is 10% of the plan balance; therefore, $3,300.00. After all calculations, Steve and Sarah must propose a Chapter 13 Plan funded with $36,300.00. That amount gets divided by 60 months resulting in a monthly Chapter 13 Plan payment to the trustee of $605.00.

Within 30 days of filing the Chapter 13 Bankruptcy, Steven and Sarah must make the mortgage payment of $2,500.00, the car payment of $365.00, and Chapter 13 plan payment of $605.00 totaling $3,470.00 per month. These payments are in addition to their other monthly bills and living expenses. The Chapter 13 trustee will require documentation and testimony from the couple, proving they are in a financial position to make all of their payments.

If all required payments get made during the 60 months, Steven and Sarah’s Chapter 13 bankruptcy will be closed, and they will exit the bankruptcy current on their mortgage and car loan and no longer required to make the Chapter 13 Trustee payment.

If you are facing Home Foreclosure, Car Repossession, or a Sheriff’s Sale, and believe Bankruptcy is an option, immediately call the Trusted and Experienced Bankruptcy Lawyer, Paul S. Peters III, Esquire. Do not make assumptions about losing your property. Using his 20 years of experience handling Bankruptcy Matters, Paul S. Peters III, Esquire will guide you through the process of restructuring your debt, proposing a manageable Chapter 13 Plan, and saving your Home or Car. DO NOT WASTE ANOTHER MINUTE!

YOU BETTER CALL PAUL!

215-291-2944

ppeters@thepetersfirm.com

Trusted and Experienced

Pennsylvania Bankruptcy Attorney

If you are considering filing a Chapter 7 or Chapter 13 Bankruptcy, contact the trusted and experienced Montgomery, Philadelphia, Bucks, Delaware, Chester, Lehigh, Lancaster, Northampton, Berks, Adams, Cumberland, Dauphin, Franklin, Fulton, Huntington, Juniata, Lebanon, Mifflin, Perry, Snyder, York Bradford, Cameron, Centre, Clinton, Lycoming, Montour, Northumberland, Potter, Sullivan, Tioga, Union, Carbon, Columbia, Lackawanna, Luzerne, Monroe, Pike, Schuylkill, Susquehanna, Wayne, and Wyoming County Chapter 7 and Chapter 13 Bankruptcy Attorney Paul S. Peters III, Esquire at:

PAUL S. PETERS III, ESQ.

215-291-2944

ppeters@thepetersfirm.com