PAYCHECK PROTECTION PROGRAM:

New Funding, New Guidelines, Return of Loans

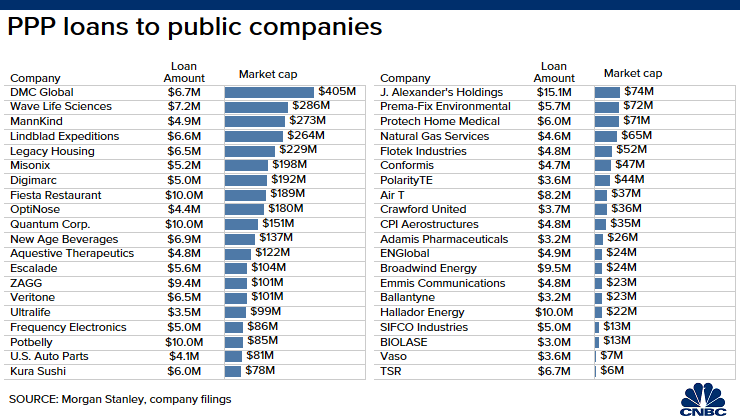

Corporate America PPP Loans

On Monday I wrote a blog post regarding the outrage over how the CARES Act’s funds given to the SBA for the Paycheck Protection Program (PPP) ran out of funding so quickly; this led to class action lawsuits and intense public and government scrutiny of large companies and banks. It has been alleged that certain large banks may have used deceitful practices to squeeze small businesses out of the running for PPP loans to allow the banks to reap large loan fees from larger businesses obtaining maximum loans. This came to light when it was discovered not so “small businesses” such as Shake Shack and Ruth’s Chris received CARES Act funds, pursuant to applications made through JP Morgan Chase Bank. In addition, to Shake Shack and Ruth’s Chris, it was disclosed in Securities and Exchange Commission filings, that other large publicly traded restaurants received CARES Act funds such as Carrols Restaurant Group, operator of more than 1,000 Burger King franchises; the Potbelly Sandwich Shop chain ($10 million); J. Alexander’s Holdings ($15 million); Sweetgreen ($10 million); and Kura Sushi ($6 million). Meanwhile, independent restaurant owners with significantly smaller operations and staff were denied PPP loans, leading to questions and criticism about who really was given first access or priority to the funds before the money ran out. The SEC filings revealed that 71 publicly traded companies obtained PPP loans.

Ivy League and other prestigious Universities CARES Act Money

While not being funds from the Paycheck Protection Program, it also came to light that the Higher Education Emergency Relief Fund, which was set up under the CARES Act to assist Institutions of Higher Education that serve low-income students, issued some of the $14 Billion in funds to institutions such as Harvard University, Yale University, Princeton University, Stanford University, and the University of Notre Dame. Those named institutions are not ones experiencing any chance of financial difficulties and all having large endowments. Harvard University, the wealthiest university in the United States has an endowment of $40 Billion, and only 16% of its enrollment can be considered low income. While none of the schools mentioned made applications or asked for the funds, they were still either made eligible or were in fact provided money based on a formula contained in the CARES Act; Harvard accepted $8.6 million in funds.

Will the Money be Returned?

Given the visceral reaction to the news of funds going to large successful companies and wealthy universities, some of the companies and universities have decided to return or reject funds from the CARES Act. Shake Shack decided to return the $10 million it received after it was able to raise $150 million on the equity market; would they have done this if not for their ability to tap the equity market? Kura Sushi posted a message on its website explaining its decision to return the PPP funds. Today, Sweetgreen announced it would be returning its $10 million loan.

Ruth’s Chris also announced it will return the $20 million PPP small-business loan it received. Ruth’s Chris operates more than 100 steakhouses across the United States, Canada, and Mexico. It managed to secure two $10 million loans, one for each of its subsidiaries. The company’s CEO, Cheryl Henry, defended the company’s initial actions stating the company was eligible for the funds it had applied for in order to protect employees and their families. “We intended to repay this loan in adherence with government guidelines, but as we learned more about the funding limitations of the program and the unintended impact, we have decided to accelerate that repayment,” said Henry. “It is our hope that these funds are loaned to another company to protect their employees.”

Regarding the loans to wealthy universities, Harvard had initially said it would allocate the funds to financial assistance for students in need because of the pandemic. However, hours after statements from federal officials criticizing Harvard, the university announced it would not accept the federal funds despite the fact that it, like other universities, was facing “significant financial challenges due to the pandemic and economic crisis it has caused.” Princeton and Yale both stated they had not requested federal relief funds and would not accept the money, while Stanford stated it requested its application be rescinded. However, Notre Dame, stated it plans to accept the federal funds but use them only to “direct financial aid to students whose families have been struck by unemployment or otherwise upended by the pandemic.”

The SBA Announced New Guidelines for the New PPP Funds

The Small Business Administration issued new guidance on Thursday hopefully making it unlikely large publicly traded companies can access the next round of funding for the PPP. Companies applying for PPP funds must certify the loans are necessary and the company cannot tap other sources of funding, such as capital markets that publicly traded companies have access to. Hence, the uproar over the Shake Shack PPP loan situation. “It is unlikely that a public company with substantial market value and access to capital markets will be able to make the required certification in good faith,” the SBA said. The SBA indicated that large public companies who tapped the PPP before the rule change can avoid scrutiny by returning the relief loans in two weeks. The PPP is set to receive $320 billion in new funding, which financial experts believe will likely be depleted in a couple of days; there is no guarantee that lawmakers will approve more money for the program after that. The new relief package guarantees that at least $30 billion of the new funds will be designated for community banks so they do not have to compete with larger institutions. The new guidelines for the second round of funding can be found here.

The government has explained that if a company applied for a PPP loan during the first round of funding and was denied or ignored, they do not need to reapply for a PPP loan.

Once the new funding is approved by Congress and signed by the President, it may take a week or two before the funding is released and available to process old and new PPP loans. Information and documentation on applying for the PPP loans may be found here.

I believe it is safe to bet that this situation will continue to develop and more disturbing information regarding the first round of PPP loan mishaps will come to light.

– Paul S. Peters III, Esquire is an attorney located in Elkins Park, PA serving clients in Montgomery, Philadelphia, Bucks, Delaware, Chester, Lehigh, Lancaster, Northampton, and Berks Counties in the areas of Employment Law & Small Business Needs, Bankruptcy, Criminal Defense, Family Law, and Estate Planning.

TRUSTED, COMPASSIONATE, ZEALOUS, AND EXPERIENCED PENNSYLVANIA EMPLOYMENT LAW ATTORNEY

If you are involved in an Employment Law matter as an employee or employer and need legal guidance, advice, and consultation in: Montgomery, Philadelphia, Bucks, Delaware, Chester, Lehigh, Lancaster, Northampton, Berks, Adams, Cumberland, Dauphin, Franklin, Fulton, Huntington, Juniata, Lebanon, Mifflin, Perry, Snyder, York Bradford, Cameron, Centre, Clinton, Lycoming, Montour, Northumberland, Potter, Sullivan, Tioga, Union, Carbon, Columbia, Lackawanna, Luzerne, Monroe, Pike, Schuylkill, Susquehanna, Wayne, and Wyoming County

It is important you contact the trusted and experienced Employment Law Attorney:

Paul S. Peters III, Esquire at:

215-291-2944

ppeters@thepetersfirm.com